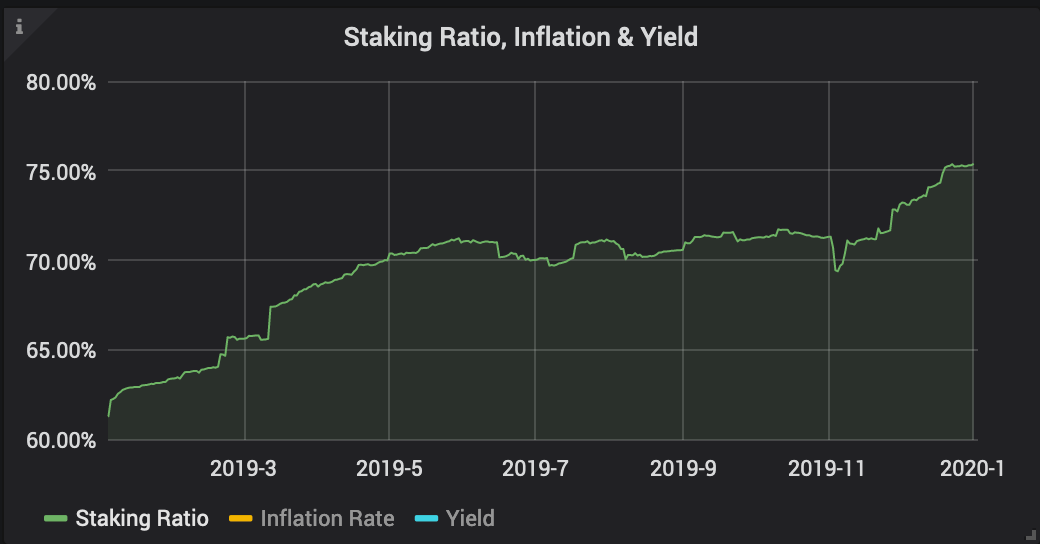

Staking

Custodial staking has been a clearly rising trend on Tezos. Since the opening of Coinbase's staking service in November 2019, a 9% increase has brought the network-wide staking ratio to 75.4% (619M), with an accompanying decrease of yield above deflation to 1.65%. 4 out of 20 top bakers are exchanges, of which Coinbase constitutes the largest Tezos baker today (36.4M), followed by Binance (20M), Kraken (11.6M), and Gate.io (8.5M).

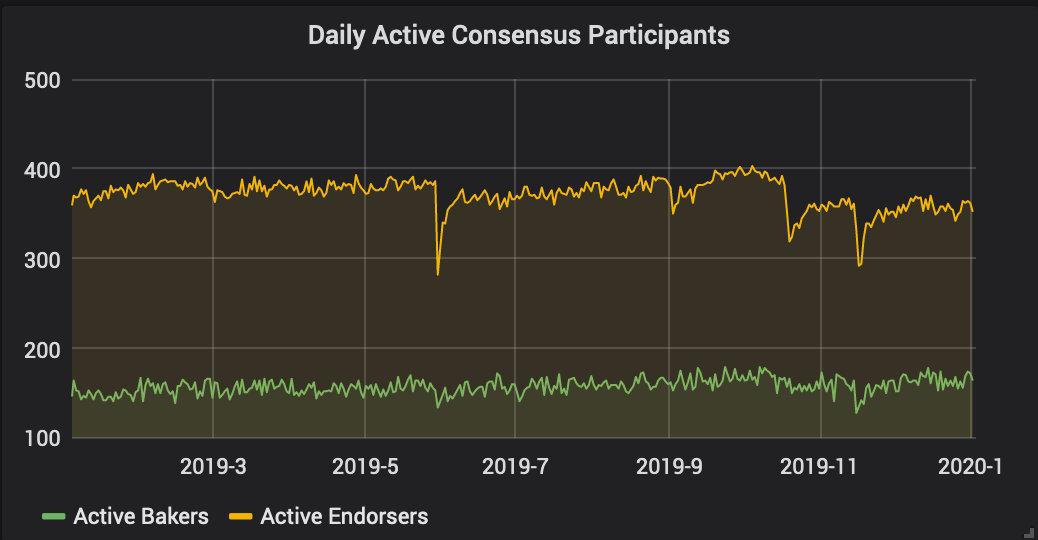

Impact of Network Upgrades

When it comes to Tezos bakers upgrading their software, 80% are on time for new protocol activations, with another 10% following within a week. A visible churn of 10% hints at increasing upgrade fatigue. Currently featuring 430 distinct validators on its network, Tezos still is one of the most distributed blockchains in the space.

Data on Network Volume

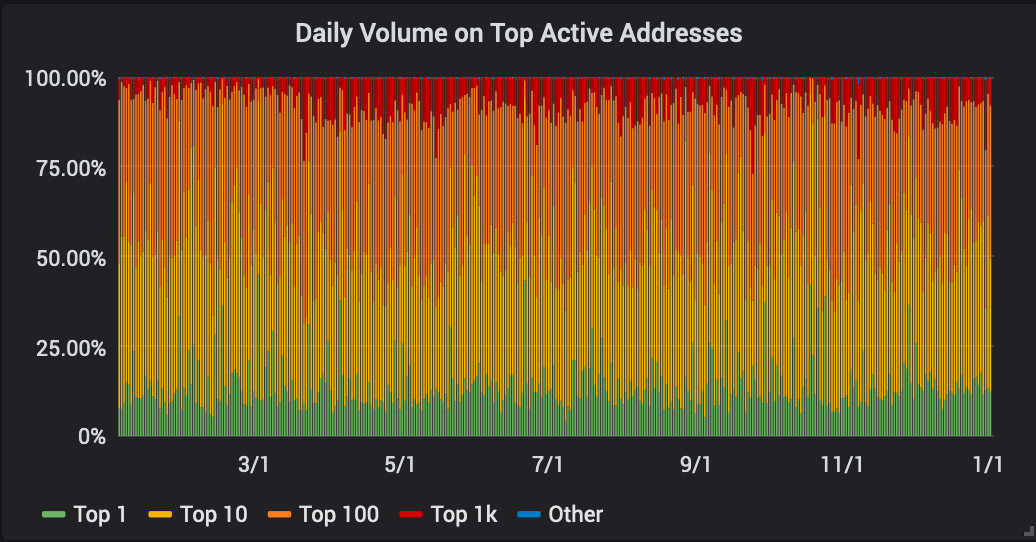

Looking at Tezos' transaction volume reveals a relatively high degree of centralization around 100 addresses. The top 10 Tezos addresses amount to at least 50% of all coins being transacted, leading to the suggestion that the network's use-cases currently do not go beyond staking payouts and speculation.

Address Growth: New Funded Addresses

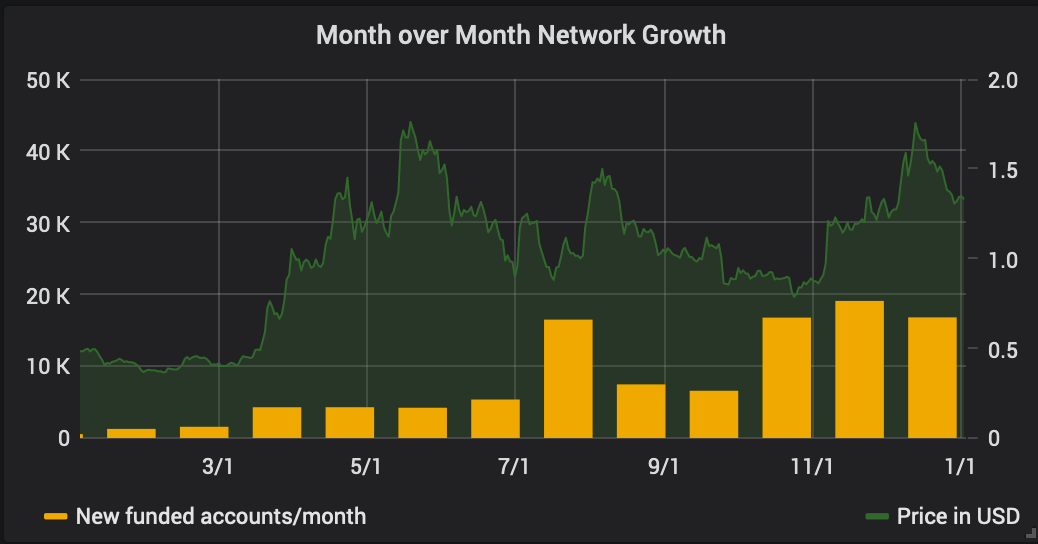

Tezos' growth has been fueled by staking and arbitrage opportunities, which reflects in acceleration to new highs in new funded addresses (15-17k per month between Oct to Dec 2019). 23.7k of a total 353k funded Tezos addresses hold more than 100 tez ($125), which marks a growth of 10% over the last 3 months. Bitcoin's monthly growth, in comparison, is about 20x higher.

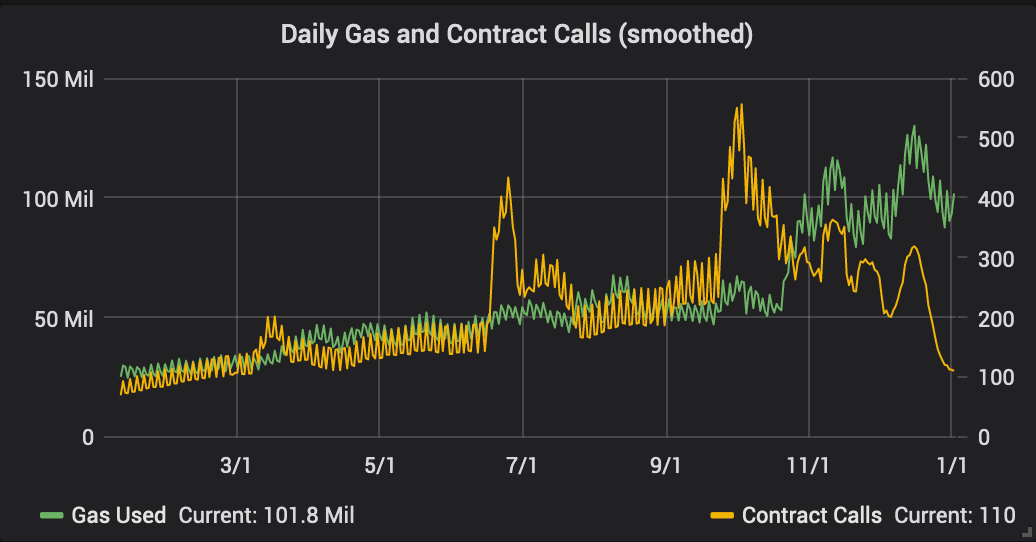

Adoption: Daily Smart Contract Operations and Gas Usage

Tezos has yet to see widespread adoption, although the amount of deployed smart contracts has increased to 230 (2.1x) after the latest protocol upgrade Babylon. This comes with a doubling of gas usage. However, the actual usage of smart contracts has been stagnant, which is likely due to more captivating use-cases still being under development.