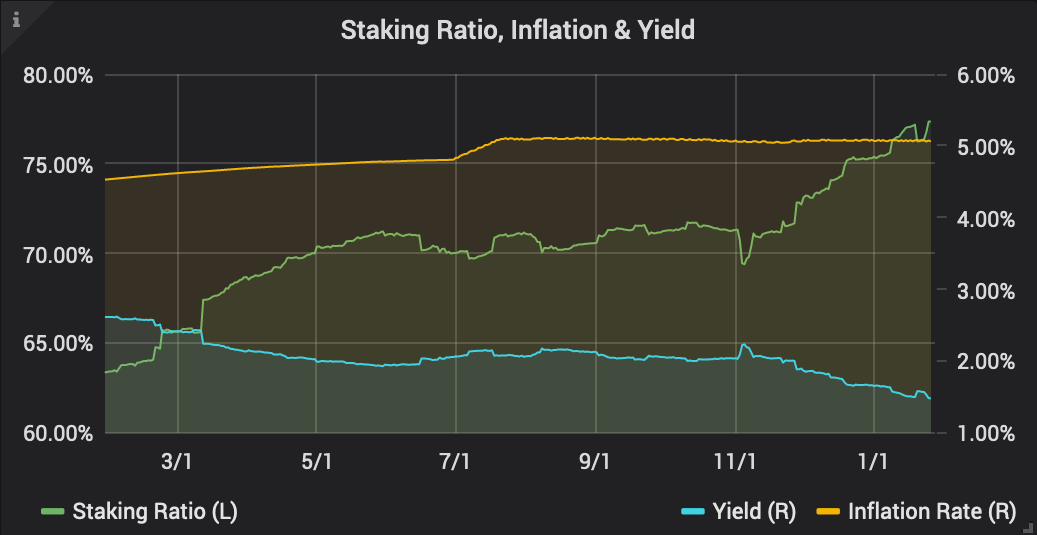

Staking

The trend of custodial staking on Tezos has continued to gain traction. In January 2020, balances staked at exchanges have seen an increase of 1.3% (26M) to 14% (89M) out of all staked tez. An overall increase of +18M in staking participation has caused a new ATH with 77.3% (635M). Staking yield has dropped to an all-time low of 1.48% above inflation. At the current tez price, one would need to stake 1.2M tez to be able to generate a base income for decent living in Berlin.

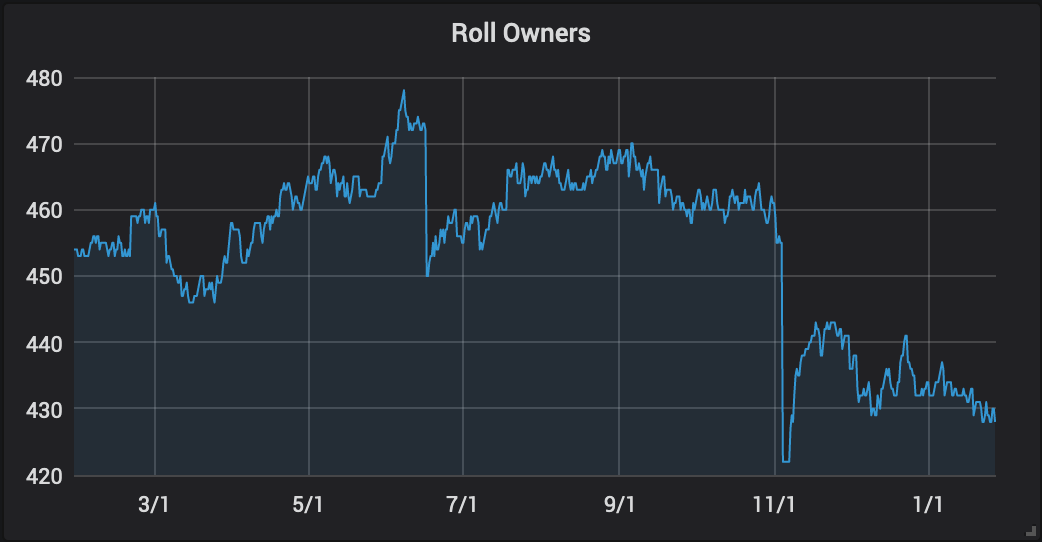

Active Validators

The number of bakers has remained stable at around 430 even with diminishing yield. In the below graph we show unique roll owners since Tezos assigns validation and voting rights based on rolls (1 roll currently equals 8,000 tez). About half of all bakers (207) are self-baking, i.e. they have <= 1 delegation directed to them. 160 bakers own a staking balance <100k tez. Overall, there are 10 self-baking whales with a balance between 1-5M tez.

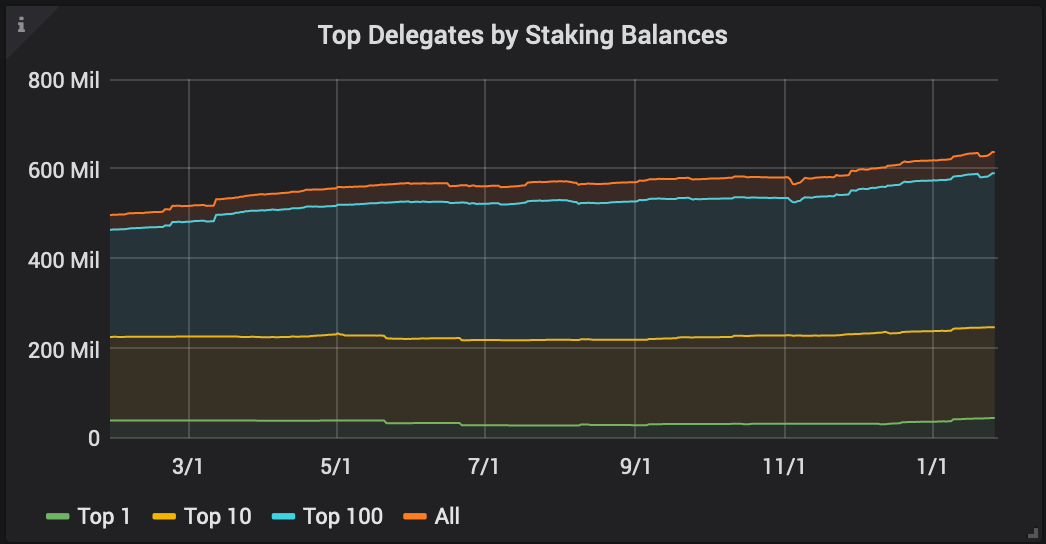

Validator Centralization

Despite the amount of unique Tezos bakers (430) being relatively high, their weight distribution paints a different picture. More than half of Tezos' staking is under the control of only 9 different entities, while 92% of the network is controlled by the top 100 bakers. The Tezos Foundation constitutes the biggest entity that validates 27% of all blocks, followed by Coinbase (5.84%), Polychain Capital (4.42%), Cryptium Labs (3.62%), Binance (3.16%), Kraken (1.96%), P2P Validator (1.93%), Airfoil (1.72%), and Flippin' Tacos (1.71%). This distribution is not an issue for consensus given the random assignment of rights, yet it is relevant for governance. Historically, the TF and some larger bakers have been abstaining from exercising votes. The rise of custodial staking has led to the Tezos community putting more pressure on exchanges to vote. Additionally, there is a new demand for the building of tools that let delegators contribute to the governance process.

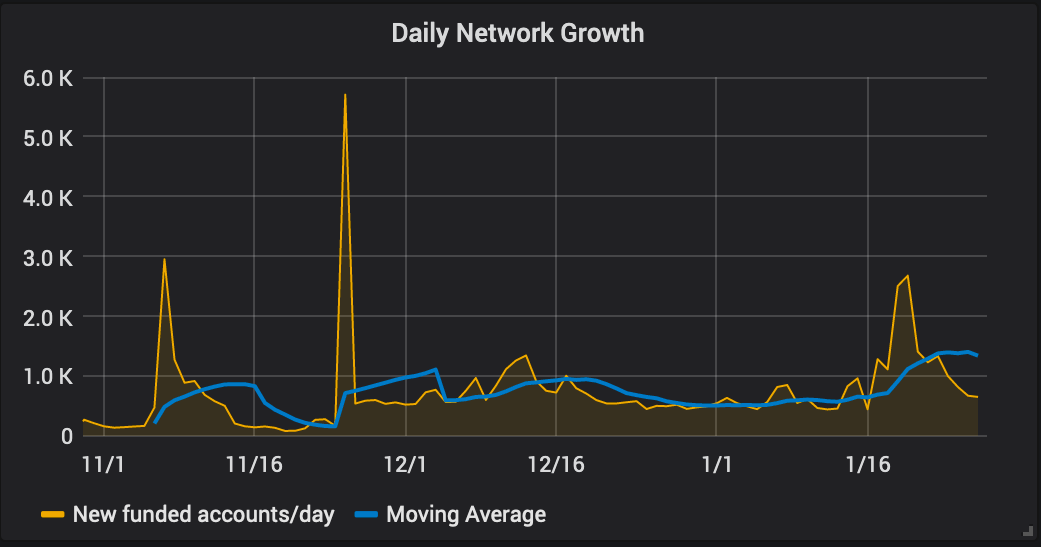

Address Growth

The growth of funded accounts on Tezos has continued with an increase of +7% (24k) throughout January. However, economically relevant accounts (>100 tez balance) have only increased to a total of 24.6k (+938), amounting to 6.6% of all 376k funded accounts. The top 1,000 Tezos accounts now hold about 67% of the total supply. This is close to Litecoin (64%) and significantly higher than Bitcoin (35%).

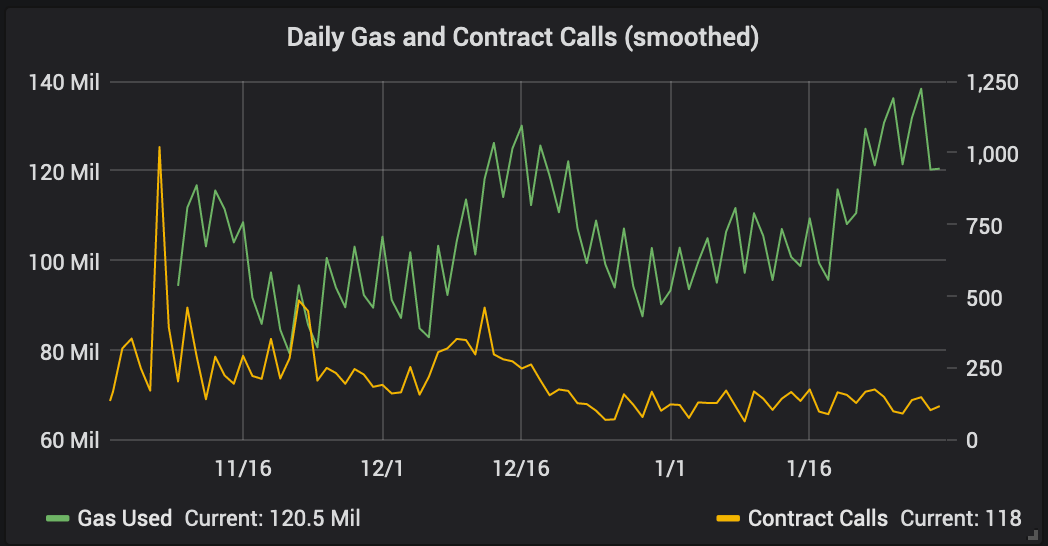

Adoption: Daily Smart Contract Operations and Gas Usage

The usage of Tezos smart contracts has not seen a significant increase so far. In January, there have only been 55 new contracts and 3.5k contract calls on mainnet, with the most prominent contract being StakerDAO. The more interesting action on Tezos' networks still takes place on the testnets. This hints at a growing developer base. Among test networks, the most active one is Babylonnet, with an all-time high of deployed contracts at 4,647 (+1,456 since Jan 1st) as well as strong growth of smart contract calls (+62k since Jan 1st, i.e. 2.6x single-month growth).