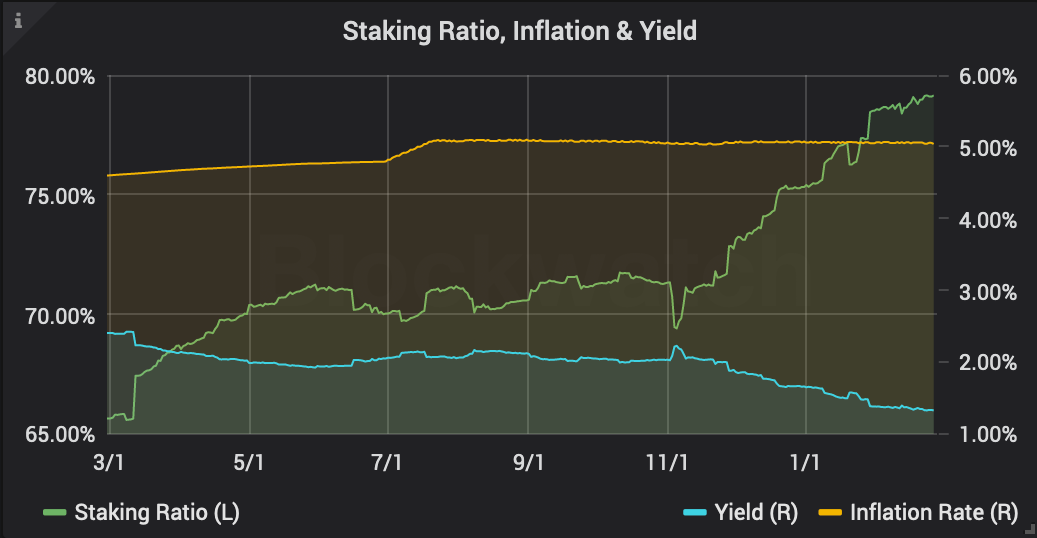

Staking

The growth of custodial staking on centralized exchanges has continued strongly. At the end of February 2020, 126.8M tez (19.4% of the staked supply, 15% of the total tez supply) are under the control of custodians, which is +27% (30.6M) compared to January. A new all-time high in network-wide staking has been reached at 79.14% (655M), with +3.2% (20M) having been newly added. To put this in perspective, last month 2.9M new tez were minted. The network's staking rewards are at 6.48% p.a., and the yield above inflation has dropped to 1.44%.

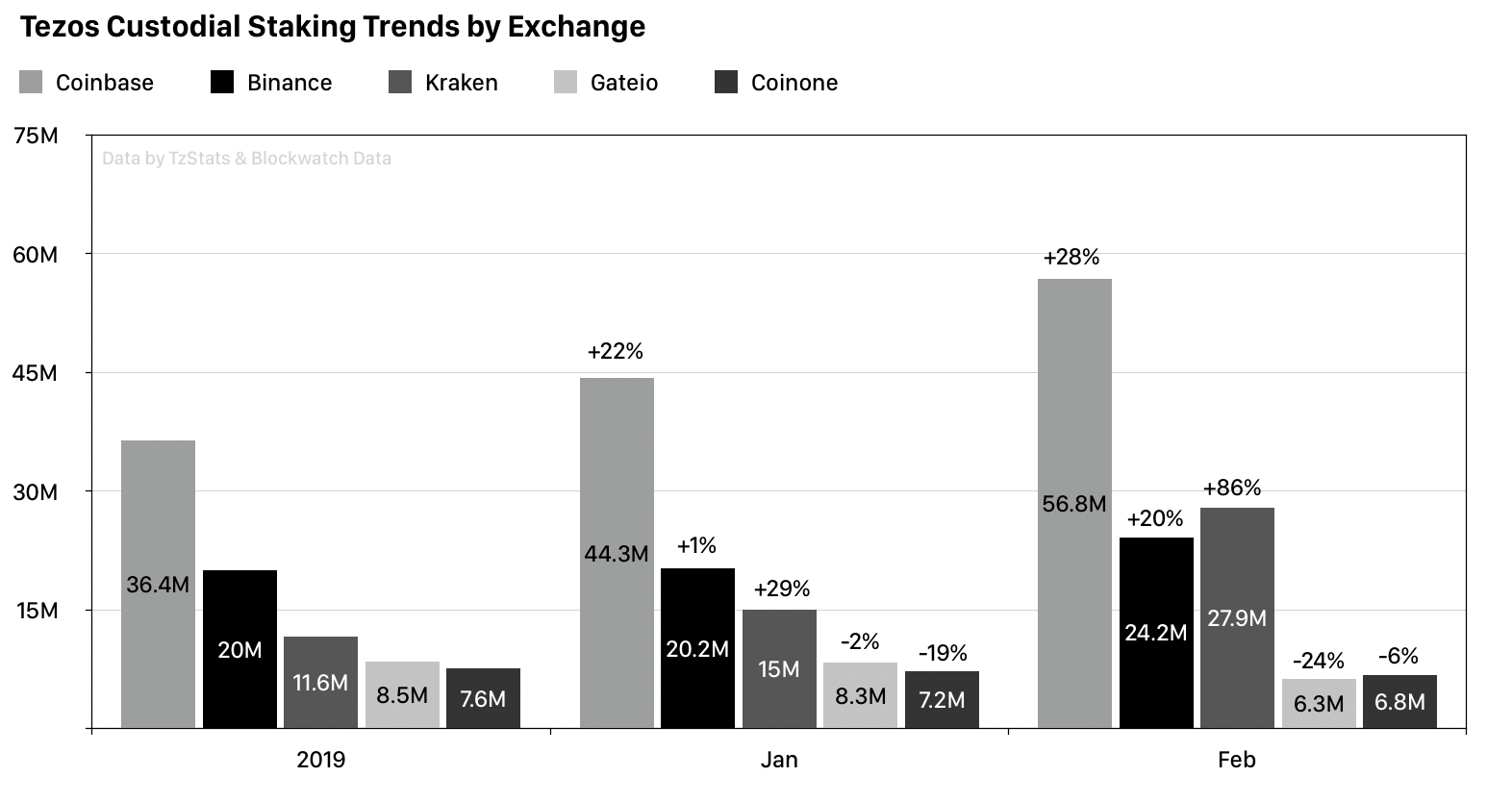

Custodians

Custodial staking has been growing at an impressive rate. Among prominent players in Tezos, Coinbase (8.4%) has become the largest staking provider over the past 4 months, followed by Kraken (4.2%). More stake is only managed by the Tezos Foundation (26.7%). Smaller custodians, on the other hand, have been on a decline. An impact of large zero-fee staking services (e.g. by Binance) on traditional bakers is shown by either shut-down or the offering of zero-fee promotions. Yet after significant initial growth, custodial growth has slowed down. There are only 128M (15%) more tez that are left to be staked, which is roughly the same amount that has been moved this month.

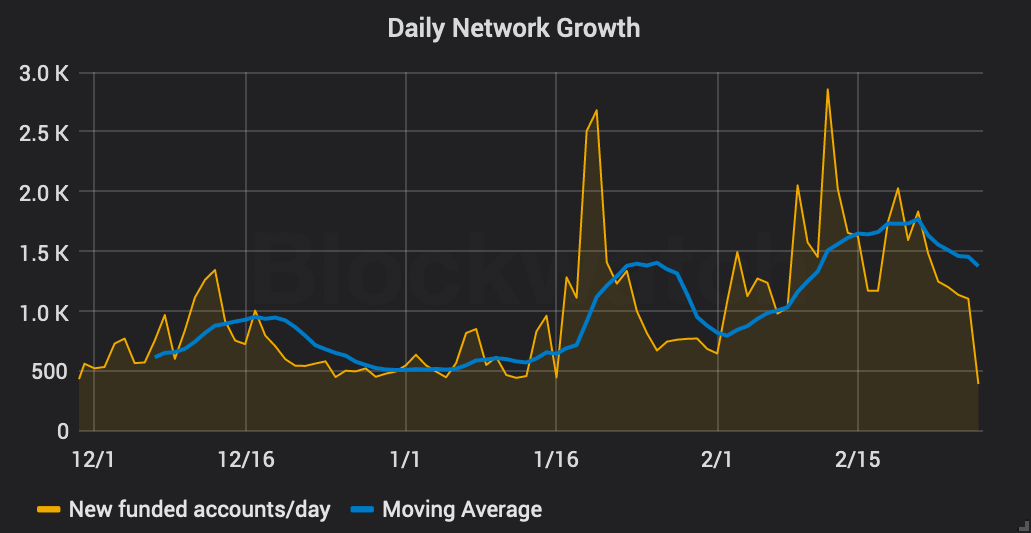

Network Growth

An increase of +10% (+37k) in funded accounts (now 418k) confirms Tezos' entering into an exponential growth phase that started in October 2019. >100 tez balance accounts have grown +9.8% to 27k, whereas the growth of 10-100 tez balance accounts has been even higher at +29% to 10.5k. The top 1,000 accounts still hold 63% of the total supply. The Gini index for >1 tez balances is at an all-time high of 0.96.

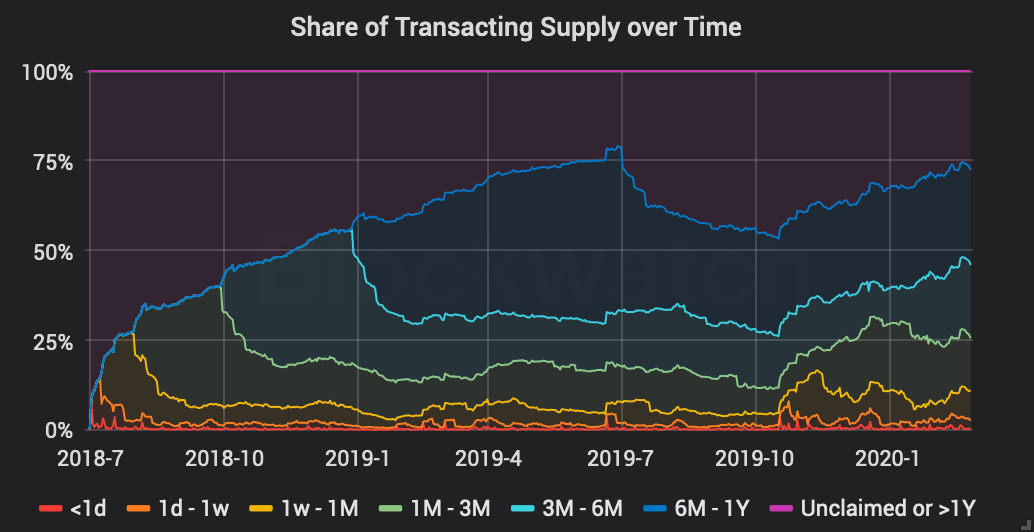

Hodl Waves

To understand how many tez have historically been moved on-chain, we analyzed transaction flows between accounts. Despite Tezos using an accounting model that is different from UTXO chains, we can measure how much was on the move – although without knowing which coins exactly. On genesis, 613M tez were minted, yet due to the necessity of activation, coin owners claimed the majority within the first year. Today, about 56M tez remain unclaimed and about 125M unvested tez are still owned by the Tezos Foundation. In late 2019, after the activation of the Babylon network upgrade, Tezos' first large-scale macroscopic shift occurred with the capability to stake from any address type and the beginning of the rise in custodial staking. Consequently, these events caused the end of the Genesis hodl wave. Another short 3-month hodl wave ended in early February 2020, albeit to a much lesser extent, due to a price rally.

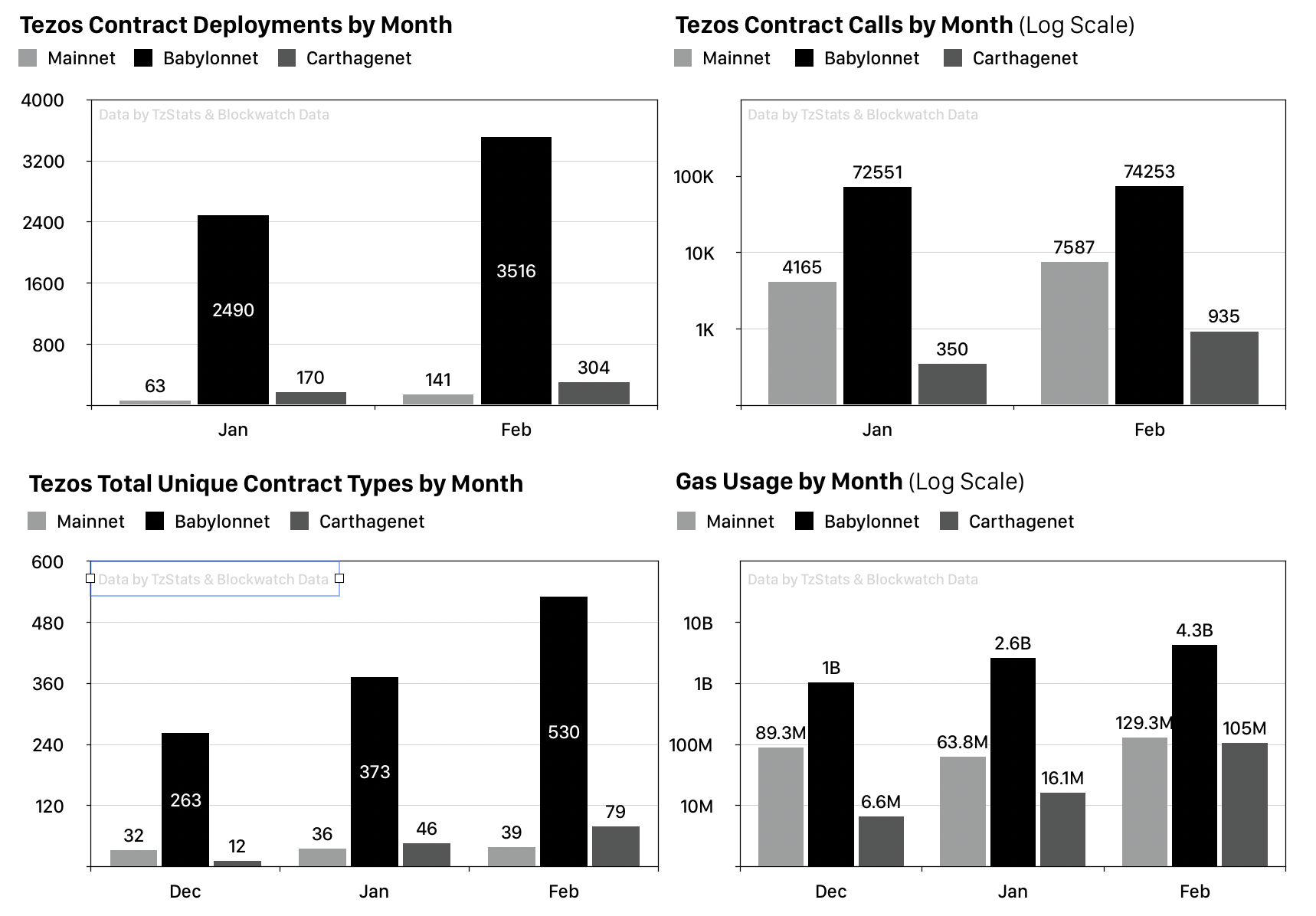

Smart Contracts Adoption

There is still more smart contract activity on Tezos' testnets than on its Mainnet. Although contract calls on Mainnet show almost a doubling compared to January 2020 (+7,587) and the starting of early experiments with the FA1.2 token standard, Babylonnet remains the most active Tezos network. With +3,516 contracts and +74k monthly calls, a new record has been hit. Yet note that many of these are test contracts that are deployed and called by automated CI systems. Looking at the diversity of unique contract types (identified by their call interfaces) there is a growth of +157 to a total of 530, with 8/10 top contract types being generic programming examples. DS Token, as used by Securitize and Elevated Returns, is the most prominent contract being worked on, with 111 total deployments and 6,6k calls in February.