Protocol Upgrade

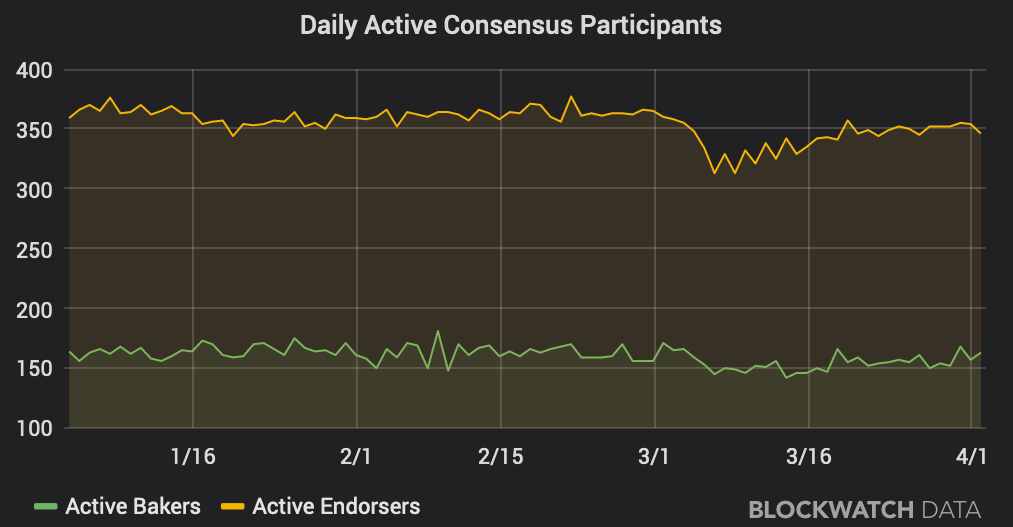

With Tezos temporarily out of the spotlight, its community has quietly been focusing on the hardening of the Tezos base layer through the third protocol upgrade (codenamed Carthage), which went live on March 5. 46% of all Tezos bakers voted in its favor, and with a backing of 72% network stake, the participation rate has shown a slight decrease compared to earlier votes (Athens: 46%/84%, Babylon: 45%/83%). As was expected for a bugfix release, the on-chain upgrade went more smoothly this time. Over 85% of bakers had upgraded their software in time. Baker churn was <3%, compared to 10% in earlier upgrades. Note that protocol upgrades in Tezos are not backward compatible as in Bitcoin, thus the entire infrastructure including indexers, wallets, and dapps must follow.

Staking

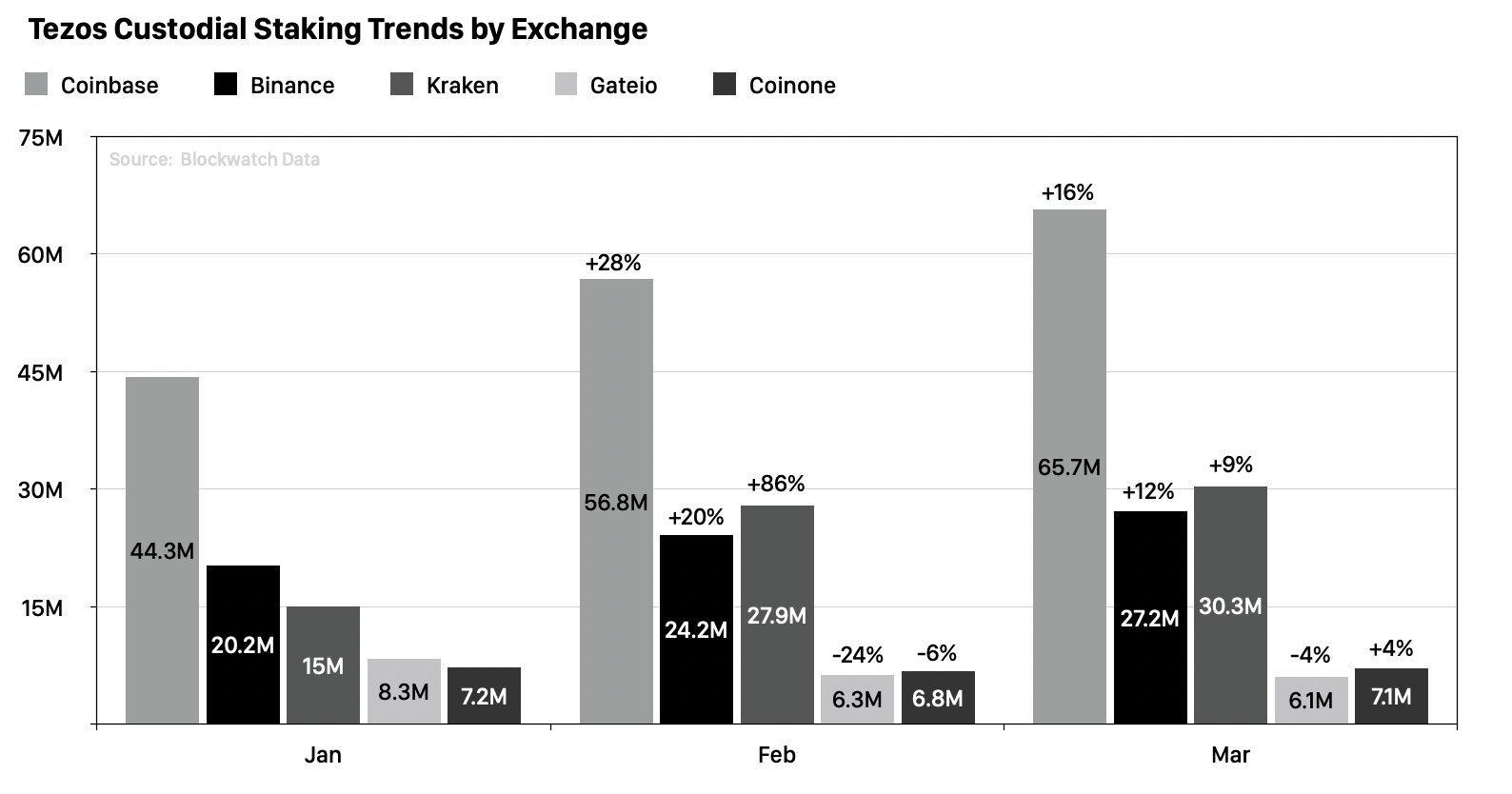

During March, strong 2-digit growth continued for the top 3 Tezos exchanges, i.e. Coinbase, Binance, and Kraken, while smaller exchange saw little change. On April 1st, 65.7M tez (10% of staking supply, 7.9% of total supply) alone was staked at Coinbase. Together, the top 5 custodian exchanges have 136M tez (21% of staking supply, 16.4% of total supply) under their management. The monthly income from staking fees for Coinbase, the largest Tezos staking provider, is at around 82.5k tez (140k USD) at these numbers.

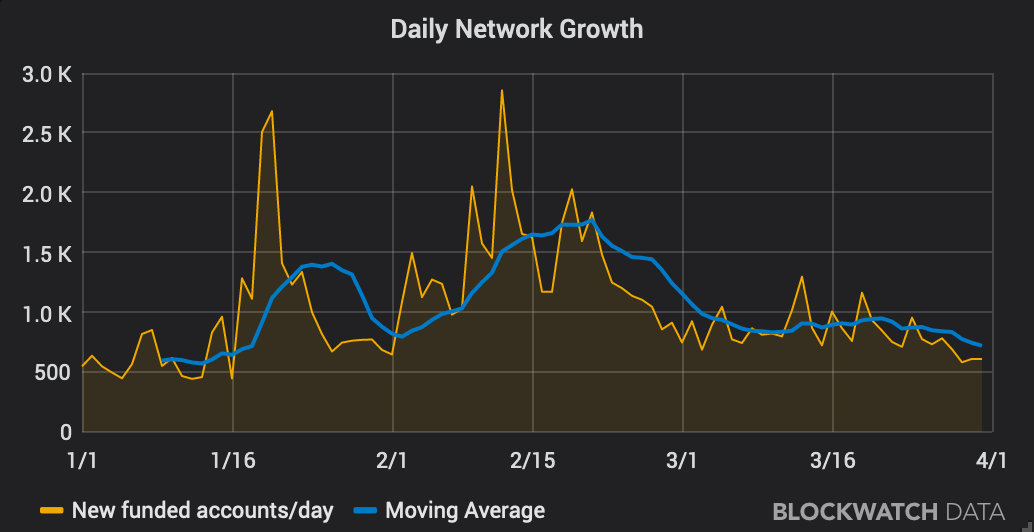

Network Growth

Throughout March, month-over-month growth slowed down to about +6% (25k accounts), the strongest growth in accounts with a balance between 100 and 1000 tez (+2k, +20%). With staking through custodians on the rise, centralization has been growing, and the top 1,000 accounts are now holding 64% of the total supply with a Gini index for balances over 1 tez at 0.9647. Large accounts with balances of 10k-1M declined, with exchanges and some whales continuing their accumulation. Last month, 6% of the total tez supply (50M) was on the move, while 77% of the supply didn't move since 3 months ago.

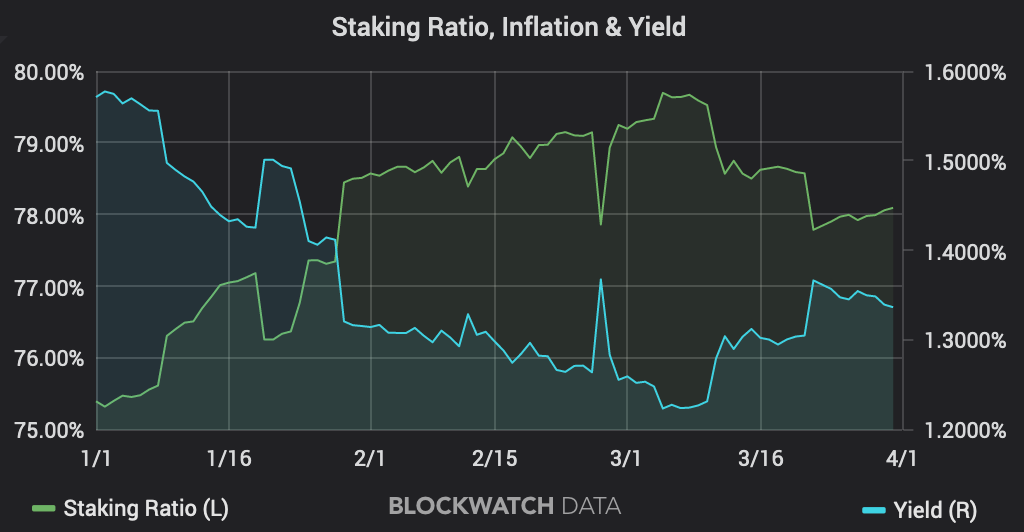

Staking

Last month, 3.3M tez were newly minted, and the network-wide staking ratio dipped back to 78.5% (-1.2%), staking rewards are at 6.07% p.a., and the future expected yield above inflation has increased to 1.3% (note: since our last post, we changed the way we calculate yield). At first glance, it appears as if the price downtrend from the heights in mid-February could have resulted in delegators and bakers liquidating parts of their stake. However, a closer look reveals that the actual opposite is the case. The total delegated supply (i.e. portion of the staking supply not owned by bakers) reached an all-time high of 522M towards the end of March. The reason for the network's staking dip is baker churn. During March, around 3% (10M baker-owned staking supply and another 7M delegated to them) went inactive.

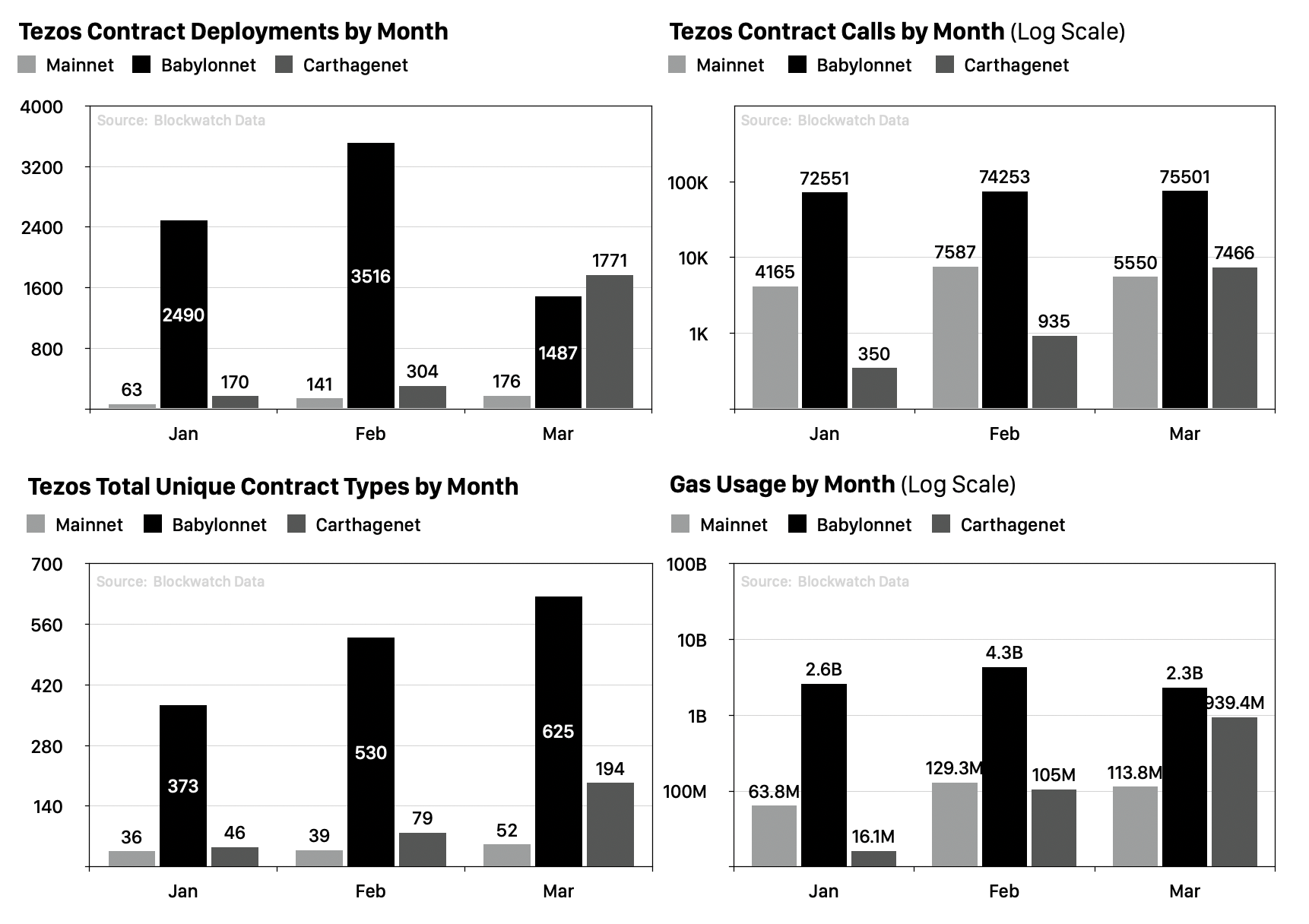

Smart Contracts Adoption

With the Babylon testnet's end of life around the corner, dev teams have slowly started to migrate over to Carthagenet. Looking at both testnets combined, there is continued developer activity growth (+10% calls) and strong growth in contract diversity (+34%). Testnet activity clusters appear to be related to new token designs and security token product demos. This is an encouraging sight. Smart contract activity on Mainnet, however, has remained stagnant in both traffic and gas. Yet real value in blockchains doesn't necessarily correlate with high traffic. StakerDAO for instance passed its third on-chain vote, and Equisafe released the first STO token backed by a real-world asset (French music pavilion) on Mainnet in early March. But despite value and fame, actual contract calls are still rare, hence it is hard to quantify the real impact for the blockchain industry with on-chain data alone.