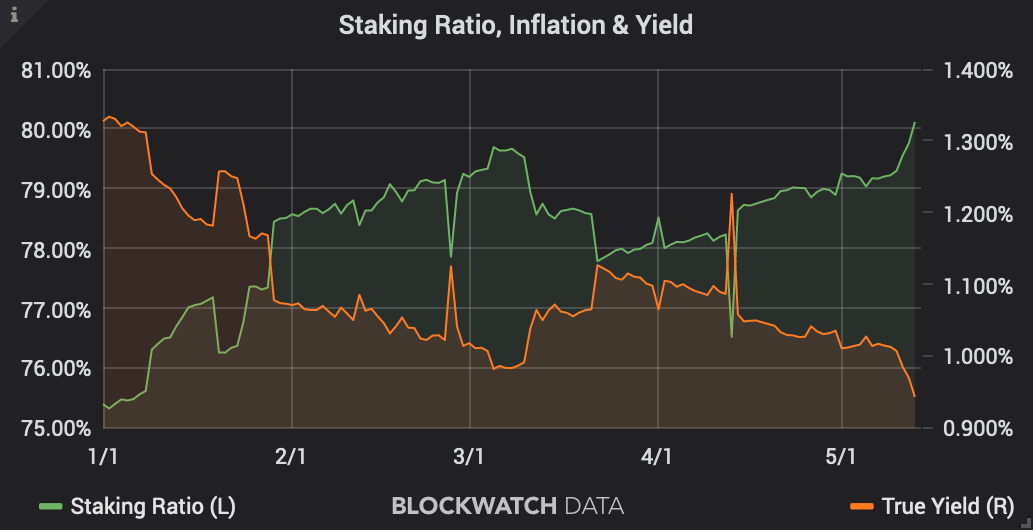

Staking

In mid-May, Tezos' network-wide staking ratio hit a new all-time high of 80.11%. Staking yield dropped to an all-time low of 0.94% with an inflation rate of 5%. This reflects true past inflation, i.e. the total amount of tez generated during the past year (39.77M tez) vs. last year's total supply. The Tezos network's absolute inflation is nearly constant, hence the inflation rate is decreasing over time. Note that due to the amount of tez generated per block being dynamic (to discourage attacks), the future inflation rate may slightly fluctuate.

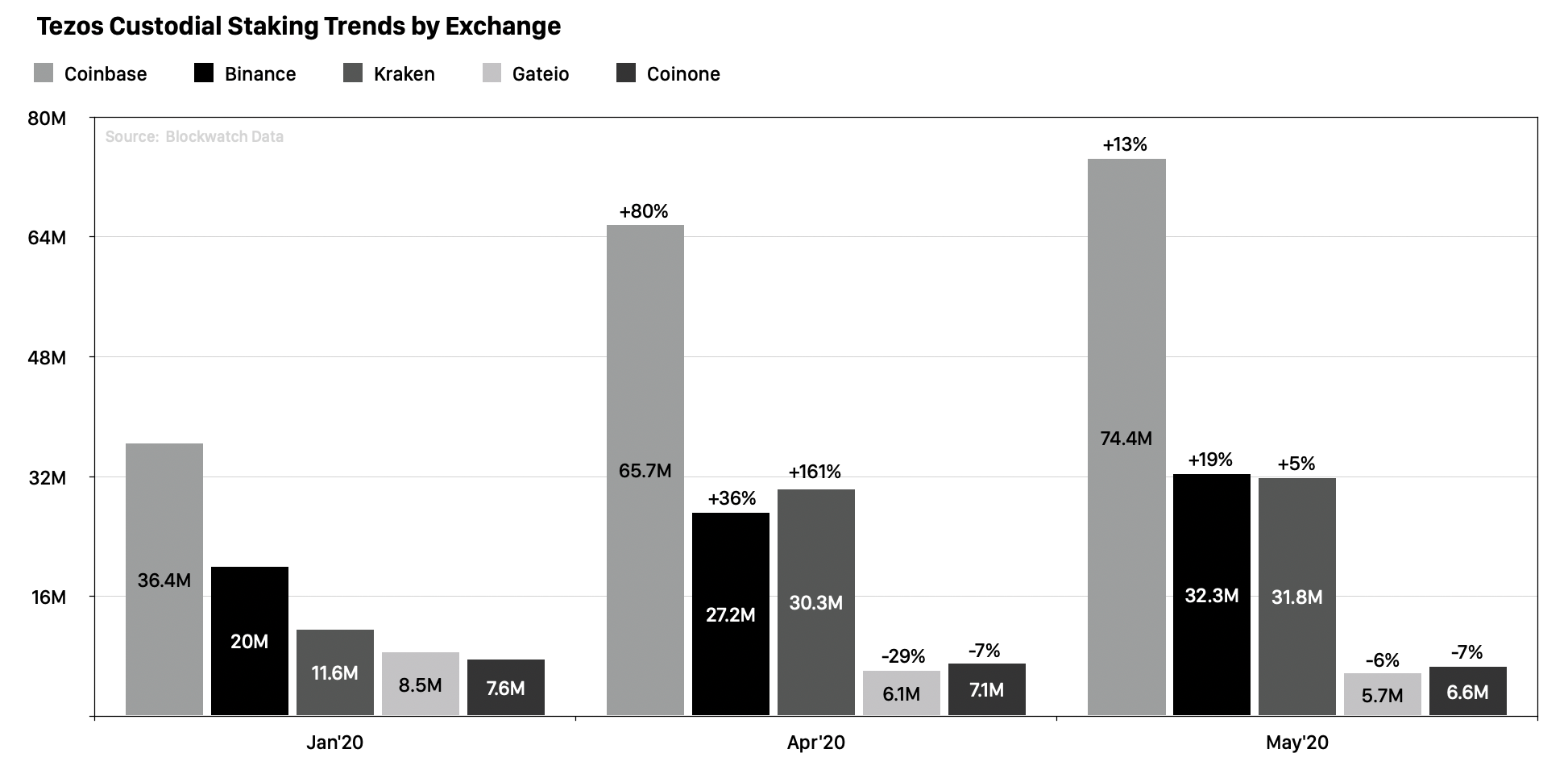

Custodians

The custodial staking trend in Tezos remains unbroken but there is a significant slow-down in Q2 so far. With another +13% gain month-over-month, Coinbase (+8.2M tez) now has 11.2% of Tezos' network consensus under its control. Together, the top 5 centralized exchanges hold 18% of the total tez supply in staking alone and even more in non-staking wallets.

Network Growth

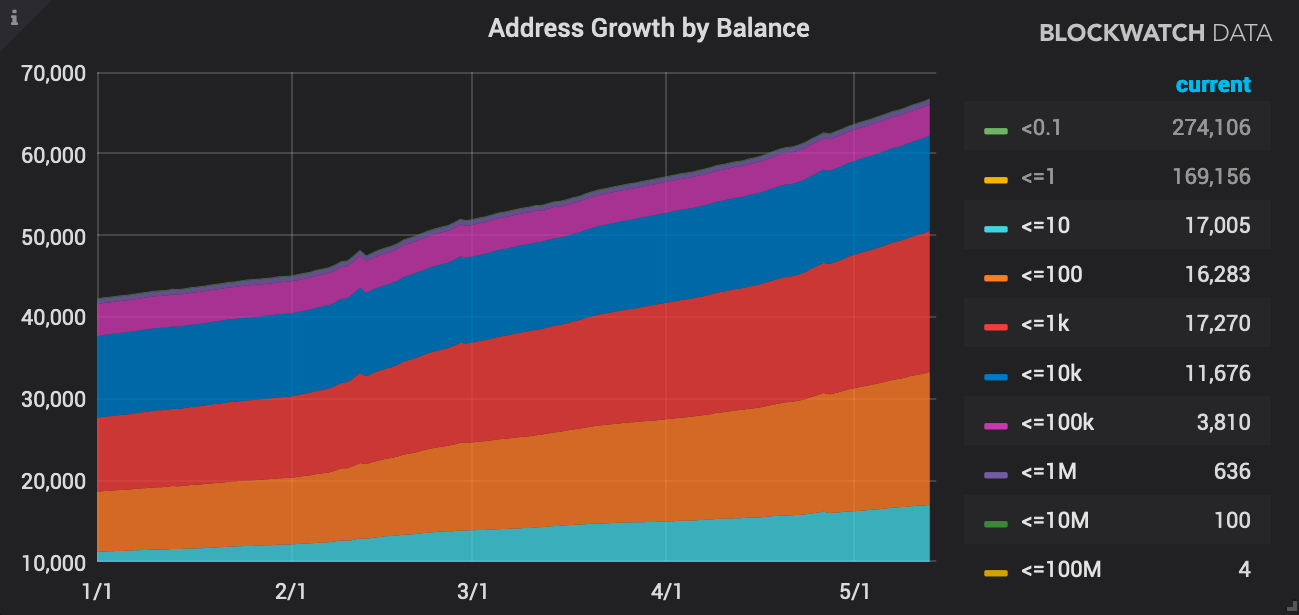

In April, there was a +8% growth of new funded accounts to a total of 35.5k. The highest rate of growth occurred in the 10 - 100 tez balance account (+3.7k, +30) range, followed by 100 - 1k tez accounts (+3k, +21.5%). Most notably, 100k - 1M balance accounts increased grew most strongly by +46 (+7.7%) to a total of 636. This indicates that both small investors and a few new whales entered the Tezos ecosystem. Looking at the total supply, the top 1k accounts hold 63% (-1% since last month). 78% of the total supply hasn't been moved for more than 3 months, and 7% (59M tez) has been moved last month.

Loyalty

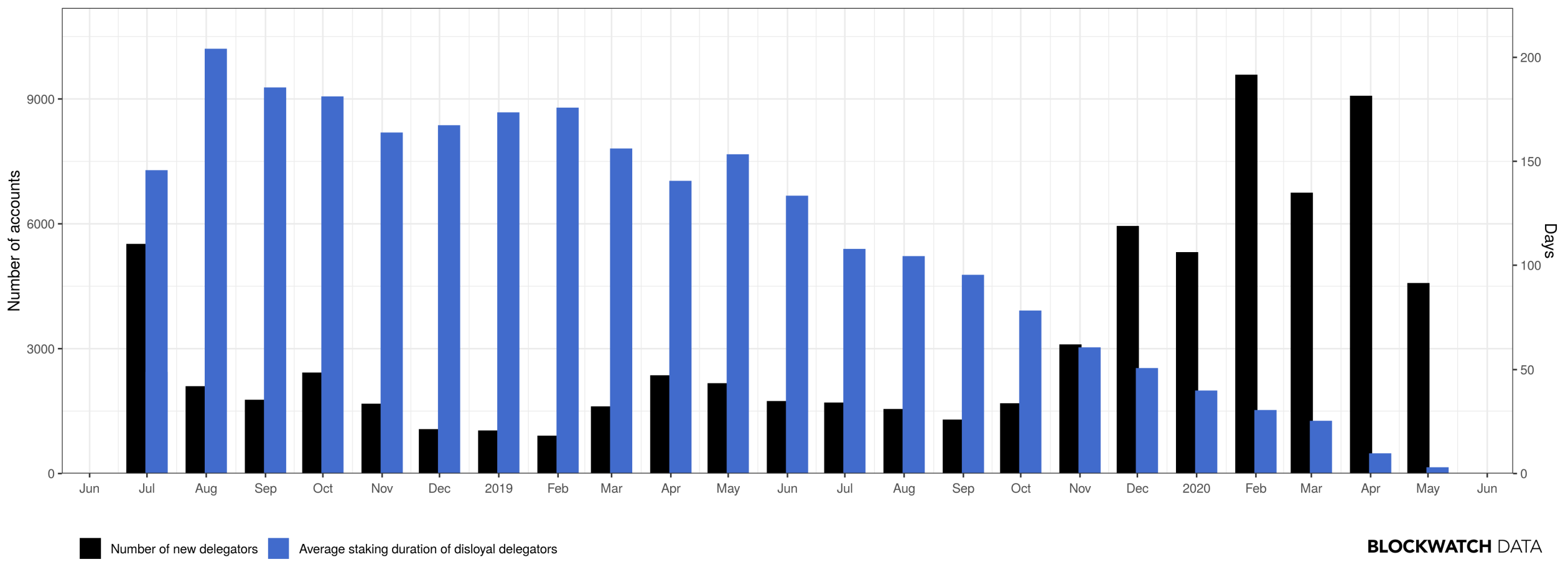

As Tezos is one of the most prominent Proof-of-Stake networks with a very close-knit community, we got interested in visualizing delegator behavior over time. For the sake of brevity, we focus on two aspects — the number of monthly new delegators (black bars) and the average time that delegators who switch their baker or sell their stake stick with their initial baker of choice (blue bars). Individual cohorts of delegators are represented by each month. We identify different waves, i.e. the genesis wave of staking in the first 4 months, a second wave that followed the price surge in spring 2019, and a much-larger third wave that followed in November 2019 with the opening of custodial staking. Individuals that hold long-term are particularly loyal to their chosen bakers, as out of 35.5k active delegators, 27.5k (77.5%) never switched. Over time, only 50% of all delegators turned disloyal, with 14% having switched their baker several times. Leaving delegators stick for one year on average. This number is rapidly decreasing with new cohorts.

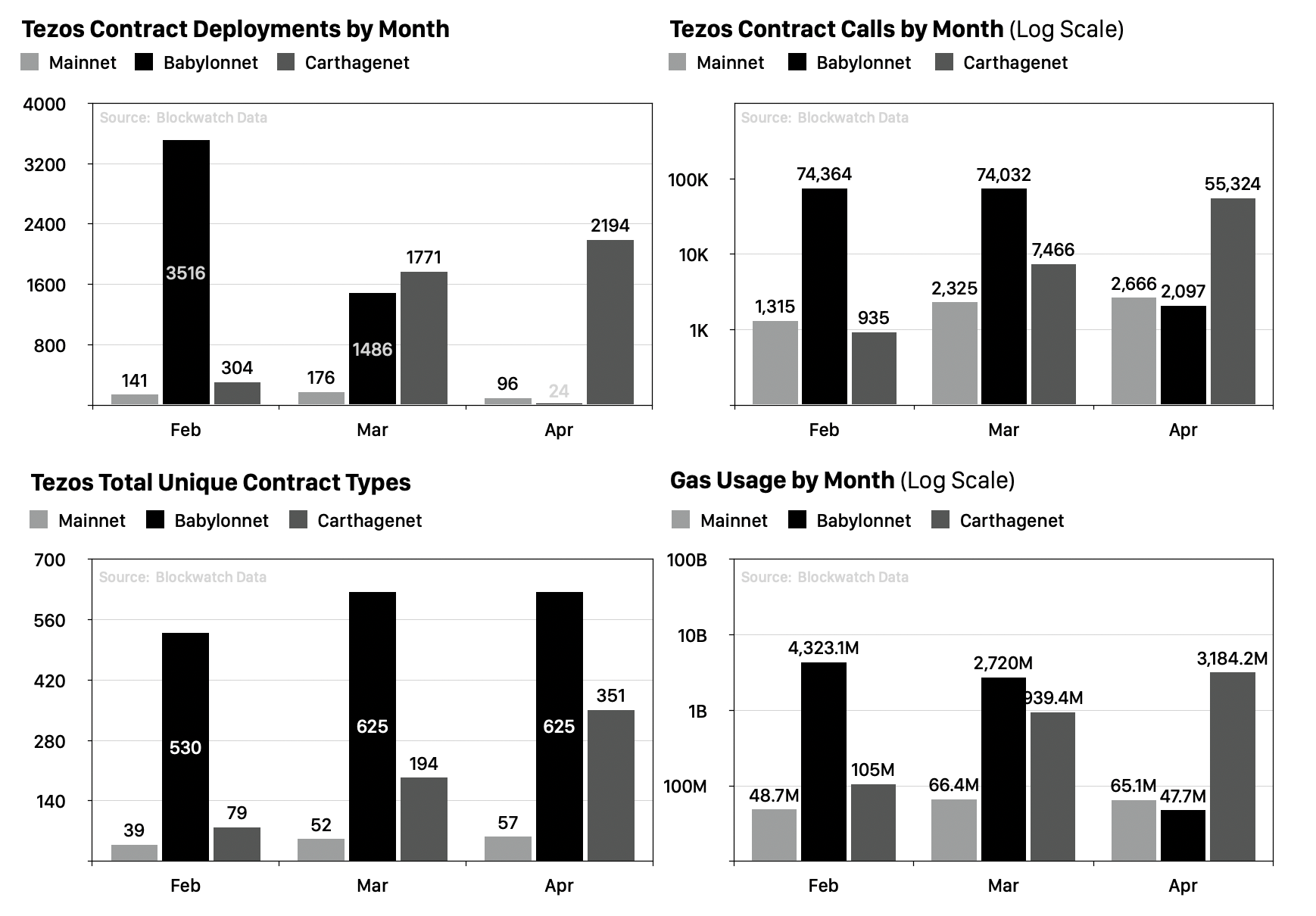

Adoption

With the shut-down of the Babylon testnet on April 8, development activity now takes place on the new Carthagenet. In terms of deployed contracts and calls, developer activity has seen less growth, yet rising gas usage suggests that the contracts under development are becoming more sophisticated. Moreover, the diversity in contract interfaces is growing. The highest activity in development can be seen in oracles, tokens, and games. Although smart contract activity is nowhere close to other still more popular chains, smart contract activity on Tezos' mainnet is improving in both traffic and gas usage. High-value assets are being deployed, e.g. tzBTC, a wrapped BTC on Tezos (with 358 Bitcoin issued at time of posting).